The PACTE Law ( Law No. 2019-486 of May 22, 2019 ) significantly reformed the statutory auditing regime for simplified joint-stock companies (SAS), thereby further increasing the attractiveness of this type of company. It was quickly supplemented by an implementing decree on May 24, 2019.

Following the position of the National Company of Auditors ( CNCC Communication of July 2019 ) and adjustments made by the law simplifying company law ( law no. 2019-744 of July 19, 2019 ), an assessment is necessary.

The main measures affecting SAS are as follows:

- The removal of the obligation to systematically appoint an auditor when a SAS controls one or more companies or is controlled by one or more companies (removal of the former paragraph 3 of article L.227-9-1 of the commercial code, only the general system applicable to all forms of companies, provided for in article L.823-2-2 of the commercial code and summarized below for the SAS, applies);

- The significant increase in the thresholds beyond which it is mandatory to appoint a statutory auditor and the setting of "group of companies" thresholds;

For non-controlled companies, they must appoint a statutory auditor if they exceed: i) 4 million euros in total assets, ii) 8 million euros in turnover excluding tax and iii) an average of 50 employees during the financial year.

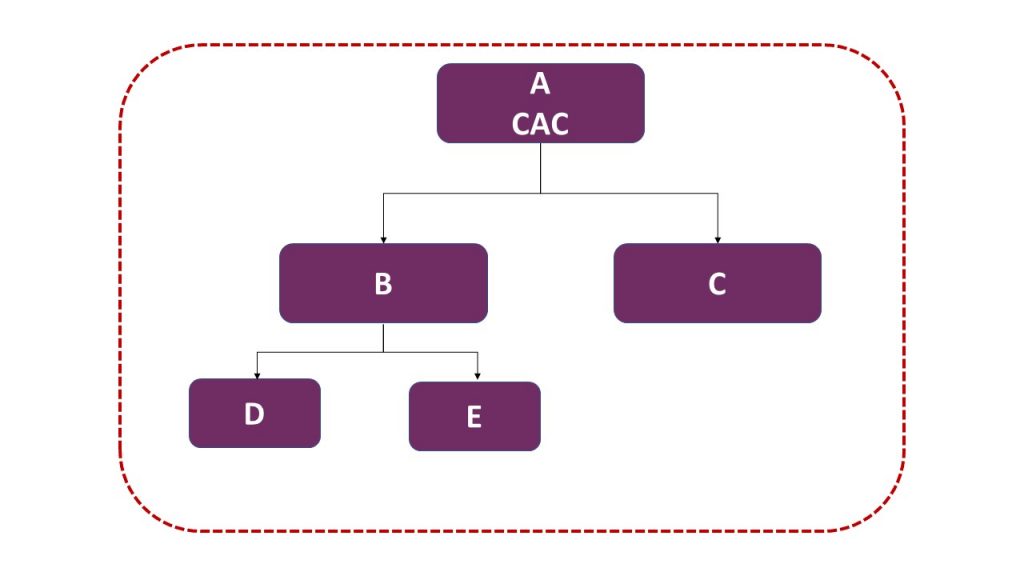

For "group head" companies, they must appoint a statutory auditor if the group they form with the controlled companies exceeds two of the following three thresholds: i) 4 million euros in total assets, ii) 8 million euros in turnover excluding tax and iii) an average of 50 employees during the financial year.

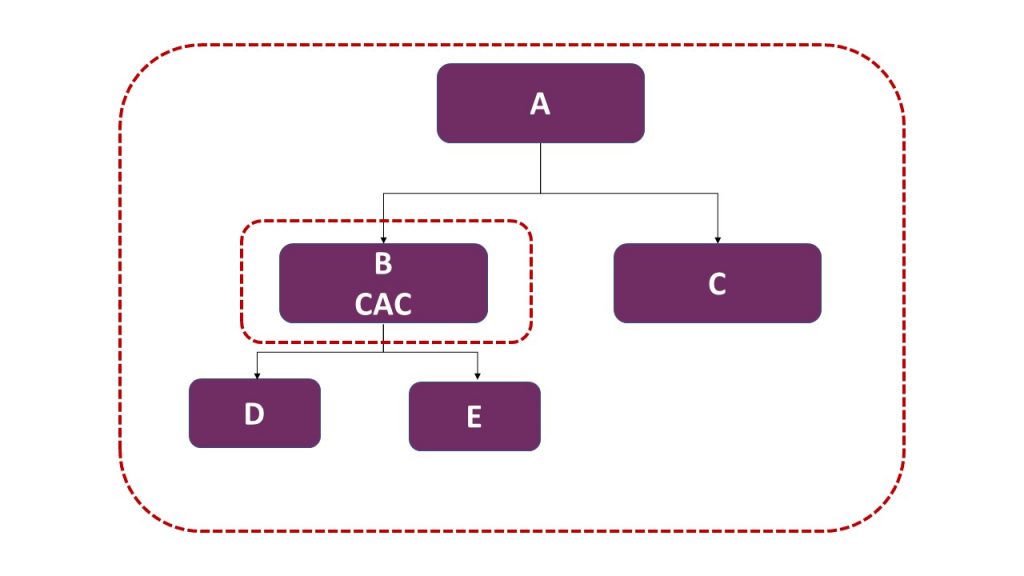

For controlled companies, and if they belong to a group exceeding two of the three thresholds above, they must appoint a statutory auditor if two of the following three thresholds are exceeded: i) 2 million euros in total assets, ii) 4 million euros in turnover excluding tax and iii) an average of 25 employees during the financial year.

Thresholds for appointing a statutory auditor

1° Uncontrolled company

If A exceeds 2 of these 3 thresholds:

- 4 million total balance sheet

- €

8 million - Average number of 50 employees during the fiscal year

2° Controlled companies: "group head"

If the total exceeds 2 of these 3 thresholds:

- €4 million total balance sheet

- €8 million in revenue excluding VAT

- Average number of 50 employees during the fiscal year

3° Controlled company

If the total exceeds 2 of these 3 thresholds:

– €4 million total balance sheet

– €8 million in revenue excluding VAT

– Average number of 50 employees during the fiscal year

AND

If B exceeds 2 of these 3 thresholds:

– €2 million total balance sheet

– €4 million in revenue excluding VAT

– Average number of 25 employees during the fiscal year

The continued possibility of requesting the appointment of a statutory auditor through legal proceedings, for one or more partners holding at least 10% of the capital ;

- The addition of the right for one or more partners holding at least 1/3 of the capital to request from the partners as a whole the appointment of a statutory auditor for a three-year term, with a statutory audit mission for "small businesses" (and not a "classic" statutory audit) . This request must be justified.

- The creation of a statutory audit "Small businesses", lighter than the "classic" certification for companies at the head of a "small group" (excluding consolidated groups and EIPs - together exceeding the aforementioned thresholds), or, for companies controlled by a company that has appointed a statutory auditor and exceeding the aforementioned thresholds, or even, for companies voluntarily appointing a statutory auditor.

The CAC will produce two reports, the classic report on the accounts for the financial year and the new report for management identifying the financial, accounting and management risks to which the company is exposed.

This latest report from the CAC will cover all companies in the group if the CAC is appointed at the level of the "group head" company.

Finally, the CAC will be exempt from certain procedures, including the preparation of the report on regulated agreements (Article L.823-12-1 of the Commercial Code provides a list of about fifteen exemptions).

The professional practice standards for this new audit were published on June 28, 2019 and are available on the CNCC website.

All of these measures lead us to believe that few SAS companies will have a statutory auditor in the future . However, we will have to wait a few years to fully understand the effects of this reform, as current mandates must continue until their expiry, even after the resignation of the appointed statutory auditor.

Finally, it is worth remembering that, in a number of SAS companies, the intervention of a statutory auditor has a significant structuring effect on the company, the development of their activities and the protection of their partners and creditors … in our view, a number of SAS companies will therefore have an interest in appointing, voluntarily or at the request of their partners, a statutory auditor, at a minimum for a “Small businesses” statutory audit.