The Pacte law ( law n ° 2019-486 of May 22, 2019 ) has profoundly reformed the system of statutory auditors in SAS, thus increasing a little more the attractiveness of this social form. It was quickly supplemented by an implementing decree on May 24, 2019.

Following the position of the National Company of Statutory Auditors ( CNCC communication of July 2019 ) and adjustments made by the company law simplification law ( law n°2019-744 of July 19, 2019 ), a statement places is required.

The main measures affecting SAS are as follows:

- The abolition of the obligation to systematically appoint an auditor when an SAS controls one or more companies or is controlled by one or more companies (deletion of the former paragraph 3 of article L.227-9-1 of the Commercial Code, only the general provisions applying to all forms of companies, provided for in Article L.823-2-2 of the Commercial Code and summarized below for the SAS, apply);

- The significant increase in the thresholds beyond which it is mandatory to appoint a CAC and the setting of “group of companies” thresholds;

For non-controlled companies, they must appoint a CAC if they exceed: i) 4 million euros in the balance sheet total, ii) 8 million euros in turnover excluding tax and iii) an average number of 50 employees during the exercise.

For the "group head" companies, they must appoint a CAC if the whole that it forms with the controlled companies exceeds two of the following three thresholds: i) 4 million euros in the balance sheet total, ii) 8 million euros turnover excluding tax and iii) an average number of 50 employees during the financial year.

For controlled companies and if it belongs to a group exceeding two of the three thresholds above, they must appoint a CAC if two of the following three thresholds are exceeded: i) 2 million euros in the balance sheet total, ii) 4 million euros in turnover excluding tax and iii) an average number of 25 employees during the financial year.

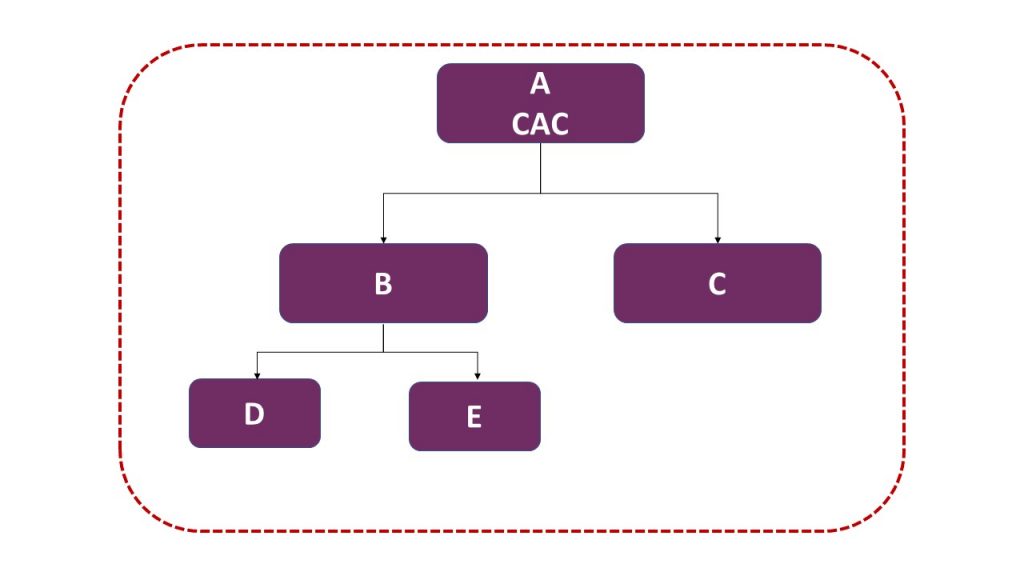

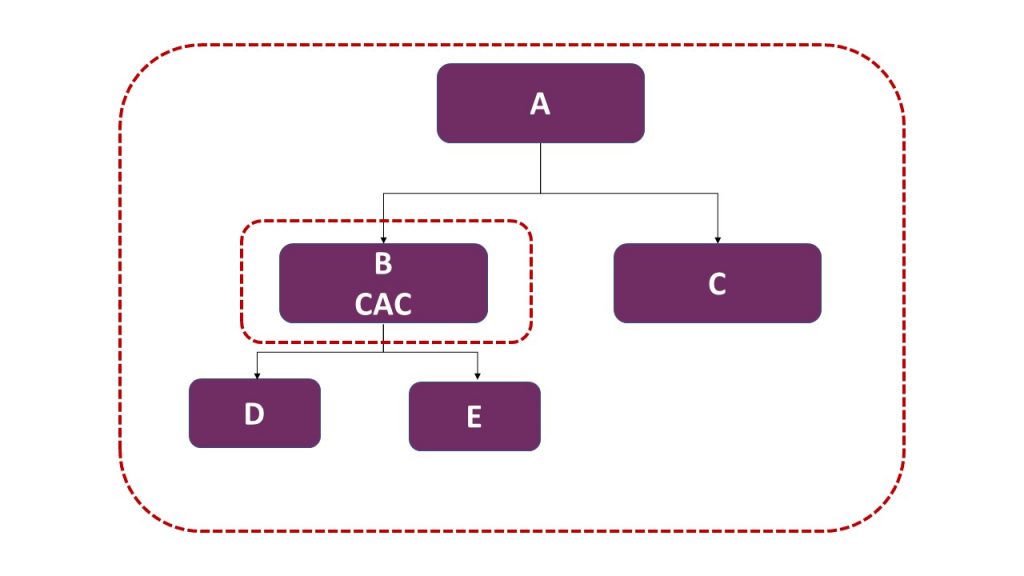

CAC designation thresholds

1° Non-controlled company

If A exceeds 2 of these 3 thresholds:

- 4 million € in the balance sheet total

- 8 million € of turnover excluding tax

- Average number of 50 employees during the financial year

2° Controlled companies: “head of the group”

If the set exceeds 2 of these 3 thresholds:

- €4 million in the balance sheet total

- 8 million € of turnover excluding tax

- Average number of 50 employees during the financial year

3° Controlled company

If the set exceeds 2 of these 3 thresholds:

– €4 million in the balance sheet total

– 8 million € of turnover excluding tax

– Average number of 50 employees during the financial year

AND

If B exceeds 2 of these 3 thresholds:

– €2 million in the balance sheet total

– €4 million in turnover excluding tax

– Average number of 25 employees during the financial year

Maintaining the possibility of seeking the appointment of a CAC in court, for one or more partners holding at least 10% of the capital ;

- The addition of the right for one or more partners holding at least 1/3 of the capital to request from the community of partners the appointment of a CAC for a three-year term, with a "small business" legal audit mission ( and not a “classic” legal audit) . This request must be substantiated.

- The creation of a "Small Business" legal audit, lighter than the "classic" certification for companies at the head of a "small group" (outside the consolidated group and EIP - together exceeding the aforementioned thresholds), or, for companies controlled by a company that has appointed a CAC and exceeding the aforementioned thresholds, or for companies voluntarily designating a CAC.

The CAC will draw up two reports, the traditional report on the accounts for the financial year and the new report for managers identifying the financial, accounting and management risks to which the company is exposed.

This last report of the CAC will cover all the companies of the group if the CAC is appointed at the level of the “head of the group” company.

Finally, the CAC will be exempted from certain procedures, in particular the preparation of the report on regulated agreements (article L.823-12-1 of the French Commercial Code provides a list of around fifteen exemptions).

The professional standards for this new audit were published on June 28, 2019 and are available on the CNCC website.

All of these measures lead us to believe that now, few SAS will have a CAC in the future . However, we will have to wait a few years before apprehending the full effects of this reform, the current mandates having to continue until their term, even after the resignation of the incumbent CAC.

Finally, let us recall that, in a certain number of SAS, the intervention of a CAC has a significant structuring effect for the company, the development of their activities and the protection of their associates and creditors ... in our view, a certain many SAS will therefore have an interest in designating, voluntarily or at the request of their partners, a CAC, at least for a “Small business” legal audit.