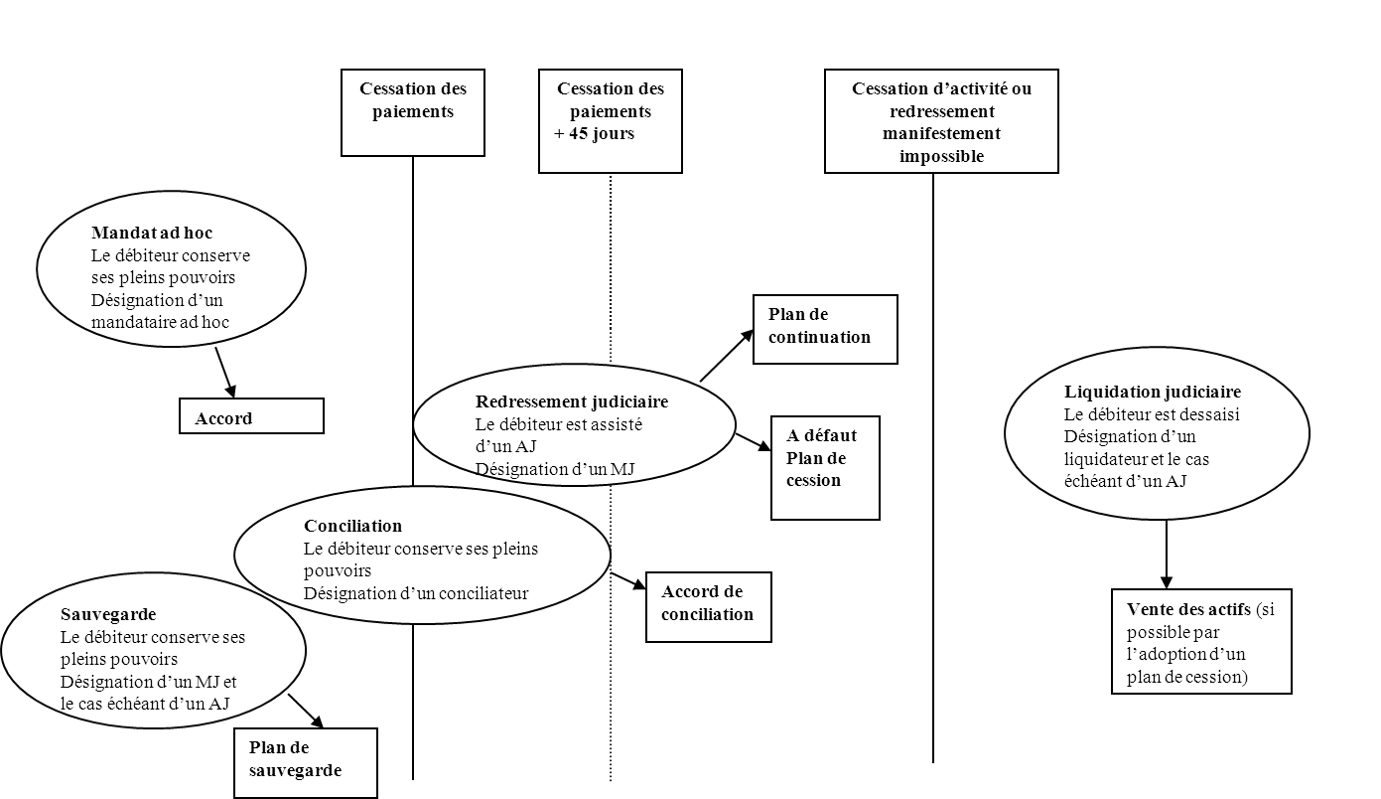

Insolvency law is both procedural (it relies on the initiation of different types of proceedings, each designed to provide a framework for addressing the debtor's difficulties) and substantive (it sets forth principles or rules of public order that modify the debtor's relationships with third parties, in order to achieve the objectives of insolvency law). Understanding how to navigate these procedures is the first step.

General organization

The law governing procedures for handling business difficulties:

1) Currently based on six main procedures, which are:

- Ad hoc mandate

- Conciliation

- Backup (available in accelerated backup and accelerated financial backup)

- Judicial reorganization

- Judicial liquidation

- Professional rehabilitation (not shown here)

2) It revolves around the concept of a state of cessation of payments, which is defined as the inability of the debtor to meet their liabilities as they fall due with their available assets.

Coordination of collective procedures

plan

The ad hoc mandate

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

| Filing of a request by the debtor with the president of the court for the appointment of an ad hoc representative (chosen by the debtor) | Order appointing an ad hoc representative and defining his mission | The ad hoc mandate process (negotiations with the company's partners to try to reach an agreement with them to end the company's difficulties) | Obtaining agreements with all or some of the partners |

| Order refusing to appoint an ad hoc representative | Lack of agreements with all or some of the partners |

The ad hoc mandate:

- It is a preventative procedure, intended to be initiated when the debtor is not in a state of insolvency

- This can continue as long as the debtor is not insolvent and negotiations continue to reach agreements with the participants

- It does not produce erga omnes (enforceable against all), third parties retaining all their rights and actions against the debtor.

Reconciliation

| Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 |

| Filing of a request by the debtor with the president of the court for the purpose of opening a conciliation procedure and appointing a conciliator (chosen by the debtor) | Order initiating conciliation proceedings | The conciliation procedure unfolds (negotiations with the company's partners to try to reach an agreement with them to end the company's difficulties or search for buyers) | Obtaining agreements with all or some of the partners | The court president acknowledged the conciliation agreement |

| Order refusing the opening of conciliation proceedings | Lack of agreements with all or some of the partners | Approval of the conciliation agreement by the court | ||

| Maximum duration of 5 months | ||||

Reconciliation:

- This is a preventative procedure, intended to be initiated when the debtor has not been in a state of insolvency for more than forty-five days

- It does not produce erga omnes (enforceable against all), third parties retaining all their rights and actions against the debtor.

- It can also be used to prepare for the sale of the company, which will take place within the framework of a judicial reorganization procedure opened following the conciliation

The backup procedure

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

| A request for the opening of safeguard proceedings made by the debtor, justifying difficulties that he cannot overcome and that are likely to lead him to a state of insolvency | Judgment initiating safeguard proceedings | Backup procedure process | Judgment approving a safeguard plan with a maximum duration of ten years |

| Judgment refusing the opening of safeguard proceedings | Stopping the safeguard procedure | ||

| Conversion to judicial reorganization | Judgment not halting a safeguard plan | ||

| Conversion to judicial liquidation | |||

| Observation period: Maximum duration of 18 months | |||

The backup:

- It is a collective procedure, which is intended to be initiated when the debtor is not in a state of insolvency

- The product has effects erga omnes (with respect to all), with prior claims of third parties being frozen.

- It primarily aims at the adoption of a safeguard plan (aimed at organizing the settlement of declared and admitted liabilities)

The judicial reorganization procedure

| Phase 1 | Phase 2 | Phase 3 | Phase 4 |

| Declaration of cessation of payments by the debtor | Judgment initiating judicial reorganization proceedings | The course of the judicial reorganization procedure | Judgment approving a continuation plan with a maximum duration of ten years |

| Referral to the court by the public prosecutor | |||

| Request to convert a backup procedure | Judgment refusing the opening of judicial reorganization proceedings | Suspension of the receivership proceedings | |

| Summons to initiate insolvency proceedings | Conversion to judicial liquidation | Judgment approving a transfer plan | |

| Observation period: Maximum duration of 18 months | |||

Judicial reorganization:

- It is a collective procedure, intended to be initiated when the debtor is in a state of insolvency and can hope for a recovery of their situation

- The product has effects erga omnes (with respect to all), with prior claims of third parties being frozen.

- It primarily aims for the adoption of a continuation plan (aimed at organizing the settlement of declared and admitted liabilities) and, secondarily, a plan for the sale of the company to a buyer

Judicial liquidation

| Phase 1 | Phase 2 | Phase 3 | Phase 4 | |

| Declaration of cessation of payments by the debtor | Judgment initiating judicial liquidation proceedings | The judicial liquidation procedure (realization of assets / settlement of liabilities) | Judgment of closure for settlement of liabilities | |

| Referral to the court by the public prosecutor | ||||

| Summons to initiate judicial liquidation proceedings | Judgment refusing the opening of judicial liquidation proceedings | Transfer plan | Sale of isolated assets | |

| Request for conversion of a safeguard or receivership procedure | Judgment of closure due to insufficient assets | |||

|

Continuation of activity: Maximum duration of 6 months |

||||

Judicial liquidation:

- This is a collective procedure, intended to be initiated when the debtor is insolvent and their situation is irretrievably compromised, or when their business has ceased

- The product has effects erga omnes (with respect to all), with prior claims of third parties being frozen.

- Primarily aimed at realizing the debtor's assets to allow for the settlement of declared and admitted liabilities